It’s been about six months since I last looked at the IDC quarterly storage market figures. The latest data for 4Q2017 has just been released, so it’s time for an update. I’ve also found some missing data, which means I can show the annual growth figures for both 2016 and 2017, providing 7 years of data from 2011. The results are certainly interesting.

Stagnant or Not?

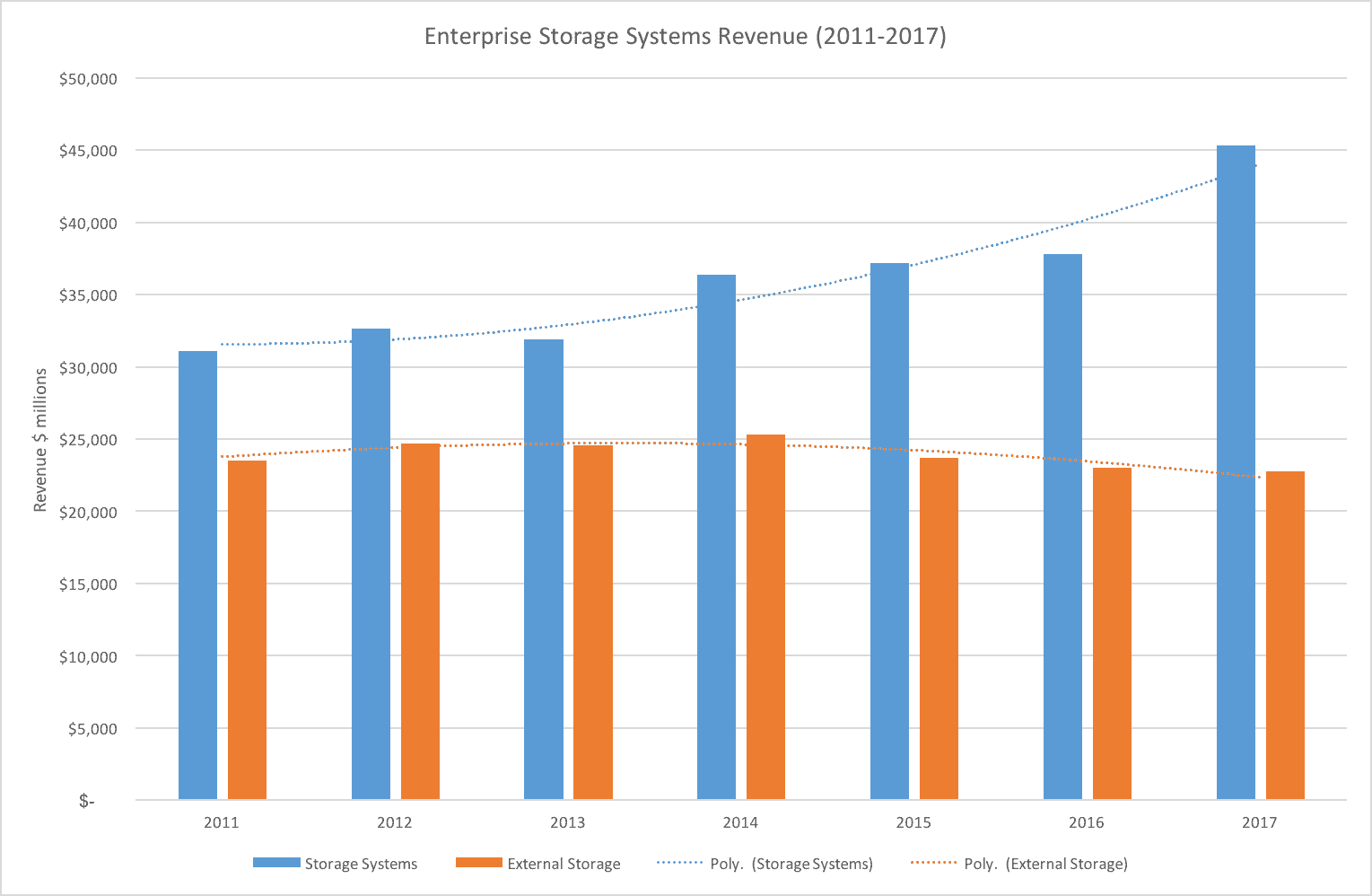

Back in 2016 I suggested that the storage market was pretty stagnant. The figures were starting to show a pretty flat or declining external array market, whereas there was some growth in servers & storage combined (but not packaged as an appliance). Figure 1 shows the updated IDC figures to 2017. The blue data is storage systems (servers with three or more disks) whereas the orange represents external storage arrays. External arrays have declined slightly since 2014 and really not changed much over the 7 year period. In contrast, servers and storage have seen a significant uptick over the period (around 50%).

Now remember these figures show revenue, not capacity shipped (or even numbers of servers). Putting that aside for a moment, the numbers do show that external storage isn’t the growth market. Instead, storage systems, which could include SDS and HCI, are seeing the growth.

Vendor Growth

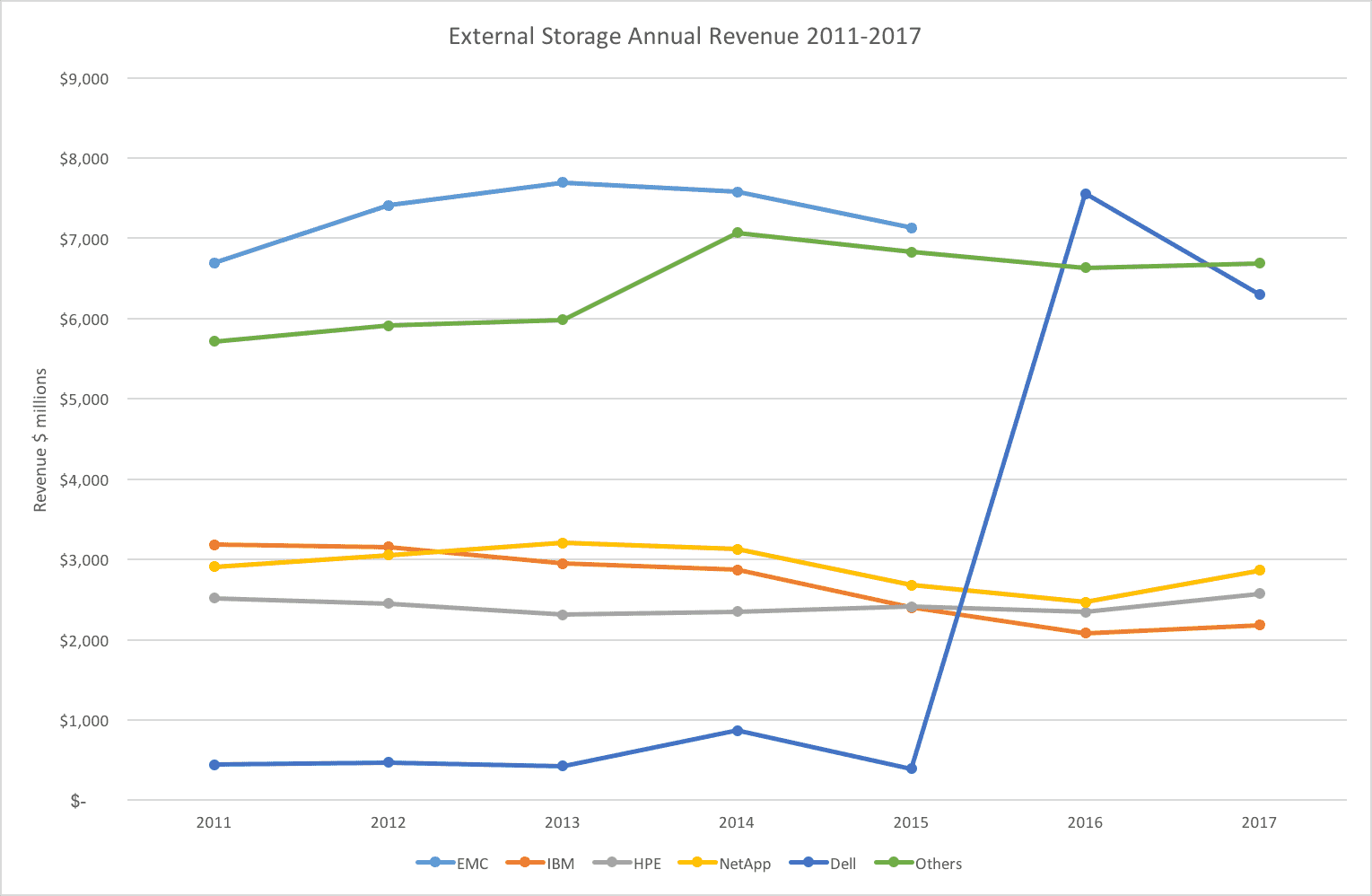

Now let’s look at the figures by vendor – see Figure 2. I’ve only included vendor data where complete years are available, which for 2011 to 2017 means EMC (and Dell EMC), HPE, IBM, NetApp and Others. Here we see IBM just about stemming the decline in their business (and to be fair the quarterly numbers do show a turnaround). NetApp are on the rise again, which we can probably attribute mostly to the adoption of all-flash ONTAP. Then there’s Dell EMC and HPE. The figures combine Dell and EMC from 2016 onwards. Unsurprisingly, the combination of both businesses pushes the graphs higher, with significant growth from 2016 to 2017. Notice also that “Others” are doing well here.

Now look at Figure 3, which shows the external storage array figures over the same period. This gives us a clue that HPE has seen only a modest growth in storage arrays. Whereas the combined Dell EMC (which represents the dark blue as the light blue figures stop) continues to show a decline in their external storage business.

ODM

Next is Figure 4, which has the limited amount of ODM (original device manufacturer) data in it. I previously mentioned the growth of these vendors, who are selling into public cloud. They are now the largest segment and growing faster than other vendors.

The Architect’s View™

I suggested when talking about ScaleIO last week that Dell seemed to be shifting business towards HCI type solutions. This data seems to bear this out to a degree. With the overall market for storage arrays remaining flat, it’s clear that new vendors (like Pure) are taking this business from the incumbents (at some point we have to stop talking about Pure as a “new” vendor), but mainly Dell EMC.

The growth in storage systems is very interesting. This is the real engine for growth in the market, Presumably from CI and HCI. I would imagine software-defined storage has some but not much impact here.

Anecdotally, it seems logical to assume that dedicated storage arrays are being reserved for those solutions that need centralised, reliable platforms and that requirement is flat or growing only incrementally. Much more data is moving to public cloud or being stored as part of hyper-converged solutions. These figures seem to bear out that assumption. What about secondary storage – is this included as a storage system or external array? Theoretically this new market should be starting to have an impact on the figures.

Four years ago I suggested that EMC should buy IBM’s server business and use the technology to build out better HCI and CI solutions. This was met with a lot of derision, but guess what, EMC now has a server base in Dell (not white box appliances), albeit with Dell being the owner. Could things have been different? If EMC had acquired a branded business with existing customers, would Dell have come calling? We will never know.

Keep an eye out for the next set of figures when we get Q1 numbers and can refresh the remainder of the graphs.

Further Reading

- Measuring the Size of the Storage Market

- Opinion: Is Enterprise Storage a Stagnant Market?

- ScaleIO Becomes Software Defined on Hardware

- Why EMC Should Have Bought IBM’s Server Business

Copyright (c) 2009-2021 – Post #4451 – Brookend Ltd, first published on https://www.architecting.it/blog, do not reproduce without permission.